The Bitcoin halving is one of the most important events in the industry because of its ability to influence supply and demand dynamics on a global scale. By cutting block rewards, the halving tightens the supply of new Bitcoins, which directly impacts miners’ operations and profitability. Miners must adapt quickly and adopt a more proactive approach to remain the backbone of the Bitcoin network and the broader industry.

Six months after the 2024 halving, miners have demonstrated a considerable amount of resilience.The path forward for a thriving Bitcoin mining industry has proven to be expansion, as the industry has had to adapt to reduced rewards, increased competition, and a significant hash rate increase.

On April 19, rewards were reduced from 6.25 BTC to 3.125 BTC per block, impacting revenue across the board. Especially for those who have been in this business for more than a few years, there has been a great deal of preparation for the halving, which reduced the overall impact on the industry.

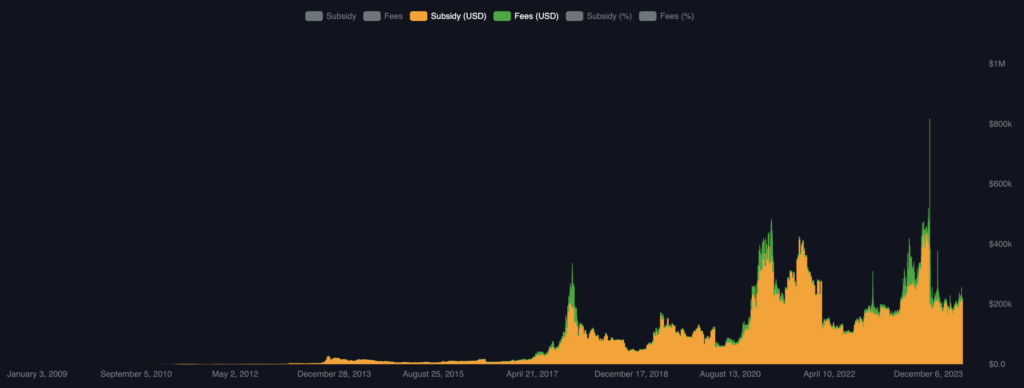

Block rewards (2009-present) – from mempool.space

Together with Bitcoin’s remarkable performance this year, miners also received an unprecedented boost in revenue, with daily fees surging to levels that reached over 1,200 BTC on halving day and (remarkably, 2,411 BTC, or 19% of the fees generated since the beginning of the year, came from the halving day and three days that followed).

The source of these new fees can be easily understood by observing the following chart, which shows the size of each block on the Bitcoin blockchain. The increase corresponds to the publication of the ordinal theory, a new protocol by Bitcoin developer Casey Rodarmor that incentivized the inclusion of non-financial data into Bitcoin’s blockchain. From digital art to BRC-20 tokens, new users have increased the amount of transaction fees paid to miners.

Block sizes (2009-present) – from mempool.space

Bitcoin Price (last 12 months) – from coingecko.com

It’s clear that miners must optimize their operations and have a clear strategic vision that focuses on expansion, innovation, and growth of their operations. Six months after the halving, GDA has announced three facilities across three continents: North America, South America, and Europe. In Argentina, while partnering with YPF Luz, Argentina’s largest energy company, GDA announced the launch of a data center powered by repurposed flared gas. The facility powers 1,200 Bitcoin mining rigs and efficiently monetizes stranded gas, which would otherwise be flared into the atmosphere.

Meanwhile, in Texas, GDA announced plans to expand its recently launched Texas data center to 400 megawatts, highlighting GDA’s commitment to Texas as a mining hub, leveraging the state’s renewable energy and pro-innovation policies.

Factors like Bitcoin price speculation and macroeconomic environment continue to shape miners and the industry. The period immediately following the halving particularly underscores the importance of adaptability, efficiency, and innovation to remain competitive, while often overlooked transaction fees allow miners to offset the pressures of reduced block rewards.